Back to Blog

Share Post:

As CDP disclosure evolves from a voluntary transparency exercise into a critical proxy for financial resilience, companies must move beyond manual reporting to maintain a competitive edge. This guide explores how the integration of AI-enabled workflows and rigorous governance evidence allows organizations to transition from basic compliance to the CDP A-List.

ESG disclosures are no longer a box-ticking exercise. It has become a strategic necessity for companies who want to build investor confidence, meet regulatory expectations, and demonstrate genuine leadership in sustainability. At the center of this landscape is CDP, the world’s leading environmental disclosure system. Each year, thousands of companies respond to CDP’s questionnaire, and their scores are closely watched by investors, regulators, and customers alike.

As an organization with deep experience in CDP and environmental impact responses, we understand the mechanics of the disclosure process and the scoring methodology. This perspective allows us to guide corporates through the complexities of CDP disclosure and help them achieve stronger scores. Our aim is not just to improve numbers, but to embed climate action into the core of business strategy, increasingly supported by practical AI-enabled tools that corporates can deploy themselves to manage data, prepare narratives, and monitor progress without depending on constant third party intervention.

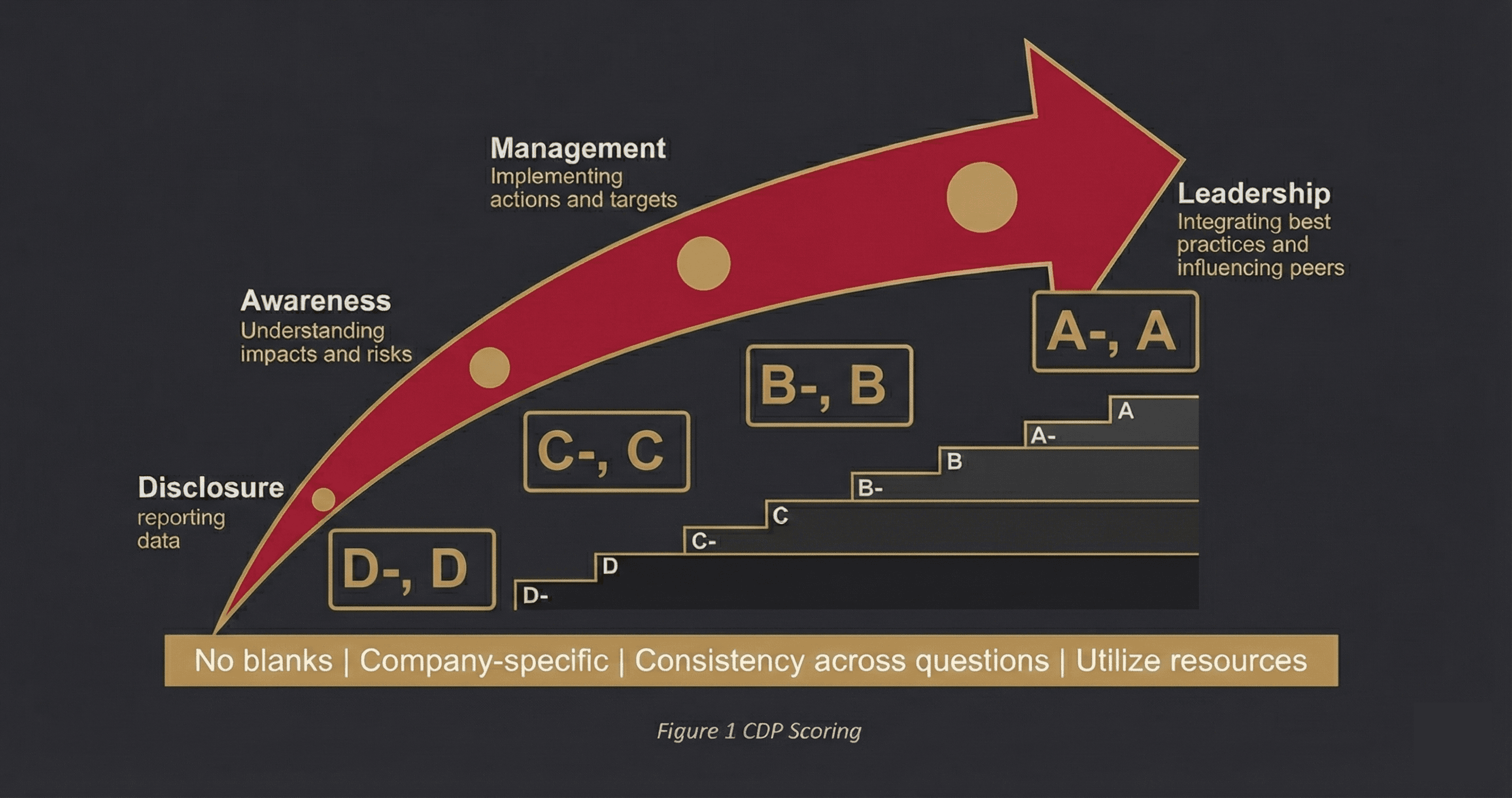

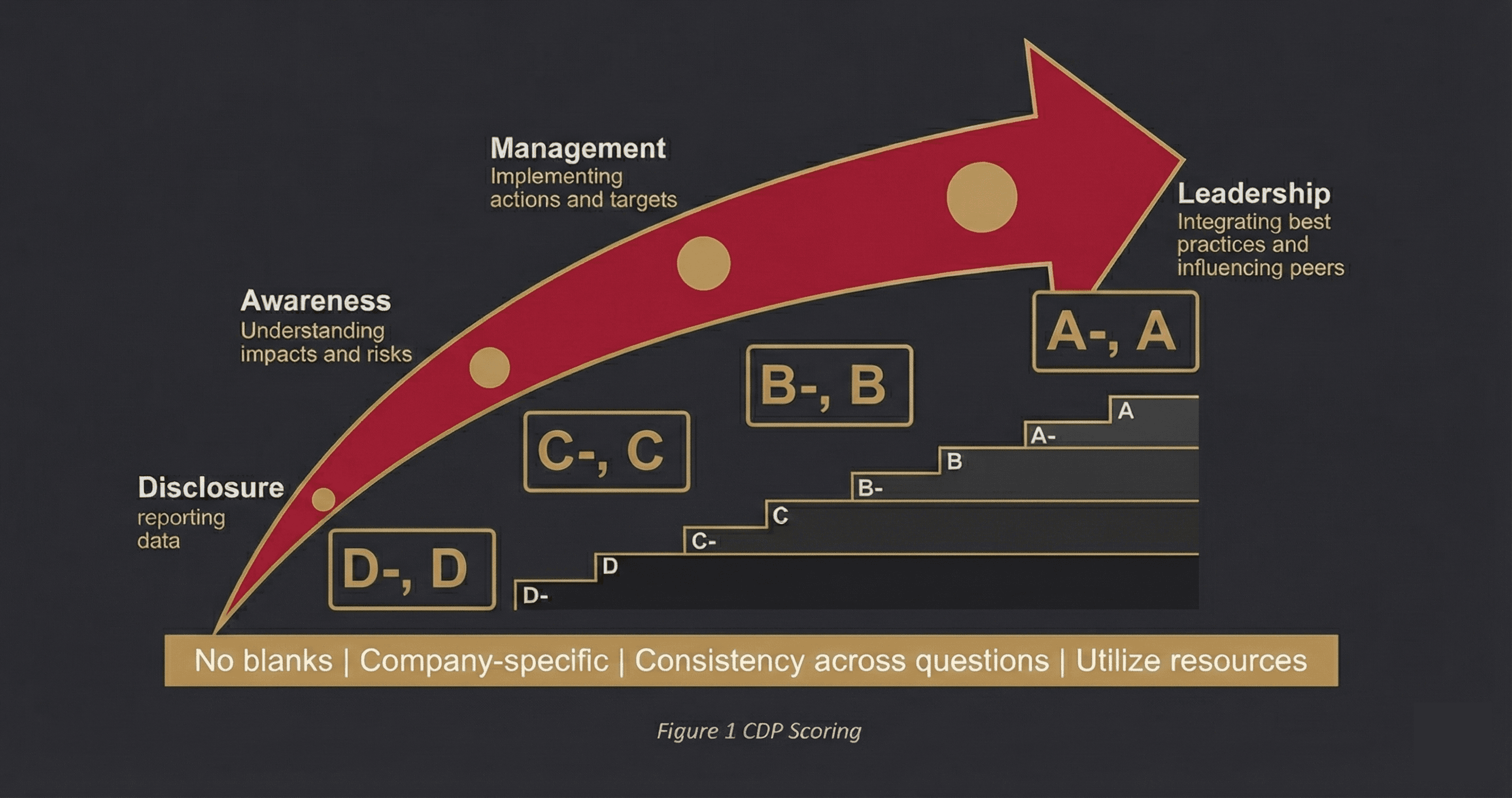

Figure 1 CDP Scoring

Why CDP disclosure matters?

A strong CDP score signals to the market that a company is serious about managing environmental risks and opportunities. Investors use these scores to assess exposure to transition and physical risks. Regulators increasingly align disclosure requirements with CDP’s framework, meaning companies that disclose through CDP are better prepared for mandatory reporting. And for customers and partners, being recognized on CDP’s A List is a mark of environmental leadership that enhances reputation and trust.

Starting early and taking steps now is critical: companies that begin preparing well before the next disclosure window have more time to refine data, secure internal approvals, strengthen governance evidence, and test AI-enabled workflows, all of which contribute to more complete and higher quality responses in the upcoming cycle. Early action also allows companies to pilot environmental initiatives and supplier engagement programs in time for them to be credibly reported in the next questionnaire. This leads them to move from basic disclosure to Management and Leadership level scores.

Navigating the questionnaire

The CDP questionnaire is comprehensive, covering governance, strategy, emissions, risk management, and verification. Companies must demonstrate board-level oversight, disclose Scope 1, 2, and 3 emissions, set science-based targets, and show how environmental risks are integrated into financial planning. Each section contributes to the overall score, with leadership points awarded for innovation and best practice.

Here, technology and AI are becoming powerful enablers. Corporates can use CDP AI solutions to consolidate emissions data from multiple systems, identify gaps against CDP’s question bank, and generate consistent responses reducing manual effort. Intelligent workflows can also track evolving CDP guidance and help sustainability, finance, and risk teams collaborate more efficiently throughout the year rather than rushing at the end of the cycle.

Common challenges

Many corporates struggle with the practicalities of disclosure. Collecting accurate emissions data across global operations is complex. Integrating environmental risks into financial planning requires cross-functional collaboration. Supplier engagement for Scope 3 emissions is often limited. And governance structures may not clearly define accountability for climate oversight. These gaps can hold back scores, even when companies are making progress on sustainability.

Just as your teams will be busy with concluding the sustainability journey for the year, acting now helps address these pain points in a structured way. By starting now, companies can phase improvements—such as enhancing data quality, piloting assurance, strengthening board documentation, and expanding supplier engagement—so that by the time the next CDP questionnaire opens, evidence is ready and internal stakeholders are aligned. Companies that treat CDP as an ongoing management process rather than a once-a-year exercise generally find it easier to move up the scoring ladder over successive cycles.

How we support corporates

This is where our expertise comes in. We help companies conduct gap analyses against CDP scoring criteria, streamline data collection and verification, align climate strategies with global frameworks, and map risks and opportunities effectively. We also design supplier engagement programs to capture Scope 3 data and ensure disclosures reflect both ambition and credibility. Our focus is always on optimizing responses so that companies move up the scoring ladder — from C to B, or from B to A List recognition.

At the same time, we encourage and enable corporates to build their own internal capabilities, including AI-enabled processes where appropriate. That means setting up robust data architectures, configuring AI tools to support CDP mapping and drafting, and training internal teams so that over time they can rely less on external support and more on embedded systems and skills—while we focus on higher-value strategic advice.

Tricks and trades for a better score

Improving a CDP score requires more than compliance. It’s about demonstrating leadership. Over the years, we’ve seen companies transform their disclosure by focusing on a few key practices:

Be specific: disclose quantified targets with clear timelines. This includes setting clear base years, defining which scopes and activities are covered, and articulating interim milestones so that progress can be tracked transparently across reporting cycles.

Verify data: third-party assurance strengthens credibility. Prioritizing assurance for Scope 1 and 2 emissions, and gradually extending to material Scope 3 categories, shows that internal controls are maturing and that investors can rely on the reported data.

Use scenario analysis: show resilience under 1.5°C and 2°C pathways. The most effective disclosures link scenario outcomes to strategic choices, such as changes in capital allocation, product mix, or site resilience measures, rather than treating scenarios as a purely theoretical exercise.

Document governance: highlight board-level accountability for environmental oversight. Clearly describing which committees oversee environmental issues, how often they are informed, and how climate performance influences executive incentives gives tangible evidence that climate is embedded in governance.

Engage suppliers: disclose Scope 3 initiatives and coverage. Mapping key suppliers, setting expectations, introducing engagement programs, and tracking improvement over time are all elements that support stronger Supplier Engagement Assessment outcomes and better Scope 3 disclosure.

Integrate finance: demonstrate how environmental risks influence capital allocation. Explaining how climate metrics and scenarios feed into budgeting, investment appraisals, risk registers, and financing decisions shows that climate considerations are shaping the company’s financial trajectory.

Showcase innovation: highlight low-carbon products and services. Without revealing proprietary methods, companies can describe solution portfolios—such as energy-efficient offerings, circular models, or green financing products—to demonstrate that ESG strategy is driving innovation and growth.

Success Stories

We have worked with corporates that moved from average scores to leadership positions by embedding these practices. Strengthening governance, enhancing data verification, and integrating environmental risk into financial planning have helped companies achieve measurable progress. The transformation is not just about disclosure — it’s about building resilience and competitive advantage in a low-carbon economy.

In many of these journeys, early preparation for the next cycle and smarter use of internal tools—including AI for data handling and narrative support—have been central to success, allowing companies to respond more confidently and consistently year on year. Over time, this combination of decisive early action, structured internal capabilities, and targeted external guidance is what tends to distinguish companies that reach and remain on the CDP A List.

Conclusion

Strong CDP disclosure is a strategic asset. It prepares companies for regulatory requirements, builds investor confidence, and demonstrates environmental leadership. With our background in CDP and deep expertise, we help corporates navigate the disclosure process, close gaps, and achieve scores that reflect both ambition and credibility.

If your company is preparing for the next CDP cycle, now is the time to act. Together, we can ensure your disclosure showcases your sustainability journey, leverages the best of both internal AI-enabled capabilities and specialized expertise, and positions you as a leader in sustainability.

As CDP disclosure evolves from a voluntary transparency exercise into a critical proxy for financial resilience, companies must move beyond manual reporting to maintain a competitive edge. This guide explores how the integration of AI-enabled workflows and rigorous governance evidence allows organizations to transition from basic compliance to the CDP A-List.

ESG disclosures are no longer a box-ticking exercise. It has become a strategic necessity for companies who want to build investor confidence, meet regulatory expectations, and demonstrate genuine leadership in sustainability. At the center of this landscape is CDP, the world’s leading environmental disclosure system. Each year, thousands of companies respond to CDP’s questionnaire, and their scores are closely watched by investors, regulators, and customers alike.

As an organization with deep experience in CDP and environmental impact responses, we understand the mechanics of the disclosure process and the scoring methodology. This perspective allows us to guide corporates through the complexities of CDP disclosure and help them achieve stronger scores. Our aim is not just to improve numbers, but to embed climate action into the core of business strategy, increasingly supported by practical AI-enabled tools that corporates can deploy themselves to manage data, prepare narratives, and monitor progress without depending on constant third party intervention.

Figure 1 CDP Scoring

Why CDP disclosure matters?

A strong CDP score signals to the market that a company is serious about managing environmental risks and opportunities. Investors use these scores to assess exposure to transition and physical risks. Regulators increasingly align disclosure requirements with CDP’s framework, meaning companies that disclose through CDP are better prepared for mandatory reporting. And for customers and partners, being recognized on CDP’s A List is a mark of environmental leadership that enhances reputation and trust.

Starting early and taking steps now is critical: companies that begin preparing well before the next disclosure window have more time to refine data, secure internal approvals, strengthen governance evidence, and test AI-enabled workflows, all of which contribute to more complete and higher quality responses in the upcoming cycle. Early action also allows companies to pilot environmental initiatives and supplier engagement programs in time for them to be credibly reported in the next questionnaire. This leads them to move from basic disclosure to Management and Leadership level scores.

Navigating the questionnaire

The CDP questionnaire is comprehensive, covering governance, strategy, emissions, risk management, and verification. Companies must demonstrate board-level oversight, disclose Scope 1, 2, and 3 emissions, set science-based targets, and show how environmental risks are integrated into financial planning. Each section contributes to the overall score, with leadership points awarded for innovation and best practice.

Here, technology and AI are becoming powerful enablers. Corporates can use CDP AI solutions to consolidate emissions data from multiple systems, identify gaps against CDP’s question bank, and generate consistent responses reducing manual effort. Intelligent workflows can also track evolving CDP guidance and help sustainability, finance, and risk teams collaborate more efficiently throughout the year rather than rushing at the end of the cycle.

Common challenges

Many corporates struggle with the practicalities of disclosure. Collecting accurate emissions data across global operations is complex. Integrating environmental risks into financial planning requires cross-functional collaboration. Supplier engagement for Scope 3 emissions is often limited. And governance structures may not clearly define accountability for climate oversight. These gaps can hold back scores, even when companies are making progress on sustainability.

Just as your teams will be busy with concluding the sustainability journey for the year, acting now helps address these pain points in a structured way. By starting now, companies can phase improvements—such as enhancing data quality, piloting assurance, strengthening board documentation, and expanding supplier engagement—so that by the time the next CDP questionnaire opens, evidence is ready and internal stakeholders are aligned. Companies that treat CDP as an ongoing management process rather than a once-a-year exercise generally find it easier to move up the scoring ladder over successive cycles.

How we support corporates

This is where our expertise comes in. We help companies conduct gap analyses against CDP scoring criteria, streamline data collection and verification, align climate strategies with global frameworks, and map risks and opportunities effectively. We also design supplier engagement programs to capture Scope 3 data and ensure disclosures reflect both ambition and credibility. Our focus is always on optimizing responses so that companies move up the scoring ladder — from C to B, or from B to A List recognition.

At the same time, we encourage and enable corporates to build their own internal capabilities, including AI-enabled processes where appropriate. That means setting up robust data architectures, configuring AI tools to support CDP mapping and drafting, and training internal teams so that over time they can rely less on external support and more on embedded systems and skills—while we focus on higher-value strategic advice.

Tricks and trades for a better score

Improving a CDP score requires more than compliance. It’s about demonstrating leadership. Over the years, we’ve seen companies transform their disclosure by focusing on a few key practices:

Be specific: disclose quantified targets with clear timelines. This includes setting clear base years, defining which scopes and activities are covered, and articulating interim milestones so that progress can be tracked transparently across reporting cycles.

Verify data: third-party assurance strengthens credibility. Prioritizing assurance for Scope 1 and 2 emissions, and gradually extending to material Scope 3 categories, shows that internal controls are maturing and that investors can rely on the reported data.

Use scenario analysis: show resilience under 1.5°C and 2°C pathways. The most effective disclosures link scenario outcomes to strategic choices, such as changes in capital allocation, product mix, or site resilience measures, rather than treating scenarios as a purely theoretical exercise.

Document governance: highlight board-level accountability for environmental oversight. Clearly describing which committees oversee environmental issues, how often they are informed, and how climate performance influences executive incentives gives tangible evidence that climate is embedded in governance.

Engage suppliers: disclose Scope 3 initiatives and coverage. Mapping key suppliers, setting expectations, introducing engagement programs, and tracking improvement over time are all elements that support stronger Supplier Engagement Assessment outcomes and better Scope 3 disclosure.

Integrate finance: demonstrate how environmental risks influence capital allocation. Explaining how climate metrics and scenarios feed into budgeting, investment appraisals, risk registers, and financing decisions shows that climate considerations are shaping the company’s financial trajectory.

Showcase innovation: highlight low-carbon products and services. Without revealing proprietary methods, companies can describe solution portfolios—such as energy-efficient offerings, circular models, or green financing products—to demonstrate that ESG strategy is driving innovation and growth.

Success Stories

We have worked with corporates that moved from average scores to leadership positions by embedding these practices. Strengthening governance, enhancing data verification, and integrating environmental risk into financial planning have helped companies achieve measurable progress. The transformation is not just about disclosure — it’s about building resilience and competitive advantage in a low-carbon economy.

In many of these journeys, early preparation for the next cycle and smarter use of internal tools—including AI for data handling and narrative support—have been central to success, allowing companies to respond more confidently and consistently year on year. Over time, this combination of decisive early action, structured internal capabilities, and targeted external guidance is what tends to distinguish companies that reach and remain on the CDP A List.

Conclusion

Strong CDP disclosure is a strategic asset. It prepares companies for regulatory requirements, builds investor confidence, and demonstrates environmental leadership. With our background in CDP and deep expertise, we help corporates navigate the disclosure process, close gaps, and achieve scores that reflect both ambition and credibility.

If your company is preparing for the next CDP cycle, now is the time to act. Together, we can ensure your disclosure showcases your sustainability journey, leverages the best of both internal AI-enabled capabilities and specialized expertise, and positions you as a leader in sustainability.

AI + Sustainability

Jan 7, 2026

Share Post:

Read More

Reblue Ventures

We aim to make sustainability simply smart business. Through research and partnerships, we develop pragmatic solutions that reveal the immense uncaptured value in sustainable operations.

Reblue Ventures

We aim to make sustainability simply smart business. Through research and partnerships, we develop pragmatic solutions that reveal the immense uncaptured value in sustainable operations.

Reblue Ventures

We aim to make sustainability simply smart business. Through research and partnerships, we develop pragmatic solutions that reveal the immense uncaptured value in sustainable operations.